See NerdWallets best high-interest online accounts. As a journalist, he has extensively covered business and tech news in the U.S. and Asia. You can generally access your savings funds at any time. If the Fed cuts rates, theres a good chance that your savings account rates will remain stagnant or fall.

In 1981 it reached its highest point 18.87 percent since 1949. Members without direct deposit will earn 1.20% APY on all account balances in checking and savings (including Vaults). And if possible, invest in a Roth or Traditional IRA as well. Interest Rate vs. APR: How Not Knowing the Difference Can Cost You, Interest Rate Forecast: See What Fed Rate Hikes or Cuts Mean. Ally Bank, for example, offers a savings account rate of 3.75% APY as of today. To be on this list, the savings account must be nationally available. By March 29, 2023 No Comments 1 Min Read. Prior to this role, he interned at two Fortune 500 insurance companies and worked in data science in the advertising industry. Special Offer Expires 09/15/2023. But if the Federal Reserve lowers or raises. When rates rise, banks tend to increase rates, but not necessarily as quickly as youd like. The rise in rates was largely due to investors demanding that they be paid at least the rate of inflation on their investments, Carey said. So, Chairman Paul Volcker (who is pictured above) kept raising rates in 1980 and '81, eventually bringing both the economy and inflation to a standstill. Even at rock bottom interest rates, everyone needs some cash to access for emergencies, short term spending goals, and day to day expenses. By clicking the 'Subscribe Now' button, you agree to our Terms of Use and Privacy Policy. The point of this information is to be aware that no one knows the future, and the past may or may not be indicative of whats next. Most banks will pay you for depositing and maintaining your savings there. We attempt to provide up to date information, but it could differ from actual numbers. Members of the Federal Open Market Committee determine the federal funds target rate. All Right Reserved. Which certificate of deposit account is best? No monthly fees, even if your account balance dwindles, Limited offerings unless you live in select states. It is not the 'best' rate offered by banks. CIT Bank was founded in 1908, and started out providing financing to businesses in St. Louis, Missouri.  Tax-Free Savings Account (TFSA): Definition and Calculation, Tax-Free Savings Accounts and Other Places to Save Tax-Free, Federal Reserve Regulation D: What It Is, Limits on Withdrawals, Simple Interest Definition: Who Benefits, With Formula and Example, Annual Percentage Rate (APR): What It Means and How It Works, Interest Rates: Different Types and What They Mean to Borrowers, Personal Loan Interest Rates: How a Personal Loan Is Calculated, The Power of Compound Interest: Calculations and Examples, What Is APY and How Is It Calculated With Examples, From Ben Franklin, a Gift That's Worth Two Fights. Although the amount is not a fortune, it's a reasonably-sized rainy-day fund, which is one of the main purposes of a savings account. The scientist, inventor, publisher, and Founding Father was a bit of a showman, so it must have given him a chuckle to launch an experiment that would not bear results until 200 years after his death in 1790. Yes Bank Savings Account Interest Rate : Yes Bank offers one of the most attractive interest rates when it comes to Savings Accounts. Its that time again when investors review their portfolios, sell holdings to harvest the tax losses, and take actions to cut tax bills and maintain their portfolios. This process of earning interest on your savings plus earning interest on all of the accumulated interest from previous periods is called compounding. You can learn more about the standards we follow in producing accurate, unbiased content in our, One Day, the Gains on Your Roth IRA Will Equal the Annual Contribution, Simple vs. Compounding Interest: Definitions and Formulas. The interest rate is the amount lenders charge borrowers and is a percentage of the principal. These rates are low, historically speaking in 1950 the rate was 1.59 percent and it rose to a whopping 13.42 percent in 1981. Longer Horizons Interest rates in the 18th and 19th centuries also provide illuminating trends. If you reinvest the interest you earned on your savings account and the initial amount deposited, you'll earn even more money in the long term. We evaluate savings accounts that are widely available throughout the U.S. to identify the best high-interest savings accounts. The higher your rate, the faster your money grows. But today, the best money market accounts have rates as high as 3.15%. How Benjamin Franklin proved compound interest's snowballing effect. 3.75% APY (annual percentage yield) as of 03/16/2023, Most banks will pay you for depositing and maintaining your savings there. Before the Great Recession in early 2007, banks such as HSBC Direct, ING Direct, Citibank, and Emigrant Direct were offering savings account yields between 4.5% and 5.05%. Some of the best savings accounts are at online institutions. Interest is compounded and credited monthly. When the Fed anticipates future inflation, it raises interest rates slightly to slow it down. The Federal Reserve controls the economy. Related: GOBankingRates' Best Banks of 2020. Banks do give customers interest on their savings accounts, but the rate is typically pretty low this is because a bank can get money from the Fed at a discount rate. The interest payments act as a form of income. Cash management accounts are typically offered by non-bank financial institutions. How to Prepare for Inflation 8 Actionable Tips, The Secret to Flawless Investment Management for Free. Many also have 24/7 customer service and robust mobile apps for online banking. Teach savvy professionals how to invest to build wealth. Want to upgrade your account?

Tax-Free Savings Account (TFSA): Definition and Calculation, Tax-Free Savings Accounts and Other Places to Save Tax-Free, Federal Reserve Regulation D: What It Is, Limits on Withdrawals, Simple Interest Definition: Who Benefits, With Formula and Example, Annual Percentage Rate (APR): What It Means and How It Works, Interest Rates: Different Types and What They Mean to Borrowers, Personal Loan Interest Rates: How a Personal Loan Is Calculated, The Power of Compound Interest: Calculations and Examples, What Is APY and How Is It Calculated With Examples, From Ben Franklin, a Gift That's Worth Two Fights. Although the amount is not a fortune, it's a reasonably-sized rainy-day fund, which is one of the main purposes of a savings account. The scientist, inventor, publisher, and Founding Father was a bit of a showman, so it must have given him a chuckle to launch an experiment that would not bear results until 200 years after his death in 1790. Yes Bank Savings Account Interest Rate : Yes Bank offers one of the most attractive interest rates when it comes to Savings Accounts. Its that time again when investors review their portfolios, sell holdings to harvest the tax losses, and take actions to cut tax bills and maintain their portfolios. This process of earning interest on your savings plus earning interest on all of the accumulated interest from previous periods is called compounding. You can learn more about the standards we follow in producing accurate, unbiased content in our, One Day, the Gains on Your Roth IRA Will Equal the Annual Contribution, Simple vs. Compounding Interest: Definitions and Formulas. The interest rate is the amount lenders charge borrowers and is a percentage of the principal. These rates are low, historically speaking in 1950 the rate was 1.59 percent and it rose to a whopping 13.42 percent in 1981. Longer Horizons Interest rates in the 18th and 19th centuries also provide illuminating trends. If you reinvest the interest you earned on your savings account and the initial amount deposited, you'll earn even more money in the long term. We evaluate savings accounts that are widely available throughout the U.S. to identify the best high-interest savings accounts. The higher your rate, the faster your money grows. But today, the best money market accounts have rates as high as 3.15%. How Benjamin Franklin proved compound interest's snowballing effect. 3.75% APY (annual percentage yield) as of 03/16/2023, Most banks will pay you for depositing and maintaining your savings there. Before the Great Recession in early 2007, banks such as HSBC Direct, ING Direct, Citibank, and Emigrant Direct were offering savings account yields between 4.5% and 5.05%. Some of the best savings accounts are at online institutions. Interest is compounded and credited monthly. When the Fed anticipates future inflation, it raises interest rates slightly to slow it down. The Federal Reserve controls the economy. Related: GOBankingRates' Best Banks of 2020. Banks do give customers interest on their savings accounts, but the rate is typically pretty low this is because a bank can get money from the Fed at a discount rate. The interest payments act as a form of income. Cash management accounts are typically offered by non-bank financial institutions. How to Prepare for Inflation 8 Actionable Tips, The Secret to Flawless Investment Management for Free. Many also have 24/7 customer service and robust mobile apps for online banking. Teach savvy professionals how to invest to build wealth. Want to upgrade your account?  Otherwise, $1 monthly for paper statements. Your email address will not be published.

Otherwise, $1 monthly for paper statements. Your email address will not be published.

How the Lack of Action on the Debt Ceiling Can Hurt the Economy, Income Inequality Has Been on the Rise Since the 1980s, and Continues Its Upward Trajectory, Census Bureau Report on Poverty and Health Insurance Coverage, CBO: Unsustainable Deficits Threaten Future Economic Growth, For A Stronger Economy, Deal With The Debt, U.S. Defense Spending Compared to Other Countries, Income and Wealth in the United States: An Overview of Recent Data. 5.78 %. Information provided on Barbara Friedberg Personal Finance is for informational/entertainment purposes only. If you click on links we provide, we may receive compensation. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. As a result, they dont have as much of a need for consumer cash reserves; thus, their incentive to offer high savings yields to attract new customers goes down.

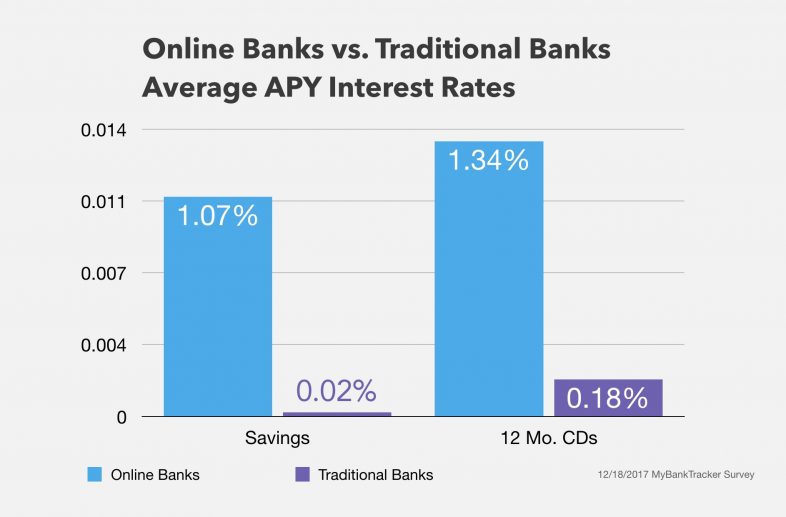

Our partners cannot pay us to guarantee favorable reviews of their products or services. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. In 2017, the savings interest rate is just 0.06 on average a rate that has held steady since 2013. And new customers can get a welcome bonus of 5,000 bonus Virgin Money Points (ends 25/01/23. Our ratings take into account a product's rewards, fees, rates and other category-specific attributes. In 2009 it reached its lowest point, 0.50 percent. Compound interest is the interest on savings calculated on both the initial principal and the accumulated interest from previous periods. Some banks specialize in high-yield savings accounts.  Understand what a savings account has to offer you with our savings account guide. The national average savings account interest rate is currently. Doing the Math on an Online Savings Account by Joe Taxpayer-We all need some ready cash; for emergencies, short term goals; and walking around money. Savings rates of 10% were not uncommon. ?uxaJ&v}oB(.#[Hv:]~[\ ip@r!~kcq~[r*oSY/\`:2 Banks raise rates when they want to gather money. Interest rates are represented by the Federal Funds rate. The federal prime interest rate is typically viewed as a lagging indicator, and financial institutions adjust their interest rates in accordance with it as economic conditions change. Annual interest rate: This is the yield you expect to earn. Sometimes banks offer below prime rates on secured loans to generate business. But the envelope was too thick to run through the shredder so I opened it up and found an old savings account passbook. Bread Savings has savings accounts and CDs, but no payment accounts. An S&L or "thrift" is a financial institution that accepts savings deposits and makes mortgage, car and other personal loans to individual The 2000s kicked off with a recession, and savings rates fell to between 1% and 2%. Still, relative to many of the other major global currencies it remains strong. The central bank has raised rates four times this year, including two consecutive bumps of 75 basis points. We also include money market accounts if they function like savings accounts. The Annual Percentage Yield (APY) for the Chime Savings Account is variable and may change at any time. The U.S. personal saving rate has declined dramatically over the past several decades and is currently very low by historical standards. "Start Earning 20x the National Average Annual Percentage Yield. Personal loan rates have fluctuated since the early 1970s, but have ultimately decreased over the last four decades. The Federal Reserve does not provide readily available data for the average national saving rates before 2009. In the 1990s, savings account rates decreased significantly, typically sitting between 4% and 5%. U se data sources for savings rates by month from which the annual averages above are derived. However, that . In the 1990s, savings account rates decreased significantly, typically sitting between 4% and 5%. However, neither city came close to the combined $21 million that Franklin calculated they would achieve. What interest bank will pay on saving account? 4, 2023. In savings accounts, interest can be compounded, either daily, monthly, or quarterly, and you earn interest on the interest earned up to that point. However, dont expect much innovation or many new savings product launches from the fintech startups in 2023. In the 1990s, savings account rates decreased significantly, typically sitting between 4% and 5%. If the boom is mostly due to the Federal Reserve decreasing interest rates, which is what we have seen many times over the past 20 years, then interest rates are declining while economic growth accelerates, Carey said. The Federal Reserve doesn't have a direct role in setting the prime rate. Yields stabilized in the second half of the decade amid a sustained economic expansion.. SoFi members with direct deposit can earn up to 4.00% annual percentage yield (APY) on savings balances (including Vaults) and 1.20% APY on checking balances. Unlike Benjamin Franklin, most of us have no desire to test what our savings might be worth in 200 years. This created a lot of competition for deposits.

Understand what a savings account has to offer you with our savings account guide. The national average savings account interest rate is currently. Doing the Math on an Online Savings Account by Joe Taxpayer-We all need some ready cash; for emergencies, short term goals; and walking around money. Savings rates of 10% were not uncommon. ?uxaJ&v}oB(.#[Hv:]~[\ ip@r!~kcq~[r*oSY/\`:2 Banks raise rates when they want to gather money. Interest rates are represented by the Federal Funds rate. The federal prime interest rate is typically viewed as a lagging indicator, and financial institutions adjust their interest rates in accordance with it as economic conditions change. Annual interest rate: This is the yield you expect to earn. Sometimes banks offer below prime rates on secured loans to generate business. But the envelope was too thick to run through the shredder so I opened it up and found an old savings account passbook. Bread Savings has savings accounts and CDs, but no payment accounts. An S&L or "thrift" is a financial institution that accepts savings deposits and makes mortgage, car and other personal loans to individual The 2000s kicked off with a recession, and savings rates fell to between 1% and 2%. Still, relative to many of the other major global currencies it remains strong. The central bank has raised rates four times this year, including two consecutive bumps of 75 basis points. We also include money market accounts if they function like savings accounts. The Annual Percentage Yield (APY) for the Chime Savings Account is variable and may change at any time. The U.S. personal saving rate has declined dramatically over the past several decades and is currently very low by historical standards. "Start Earning 20x the National Average Annual Percentage Yield. Personal loan rates have fluctuated since the early 1970s, but have ultimately decreased over the last four decades. The Federal Reserve does not provide readily available data for the average national saving rates before 2009. In the 1990s, savings account rates decreased significantly, typically sitting between 4% and 5%. U se data sources for savings rates by month from which the annual averages above are derived. However, that . In the 1990s, savings account rates decreased significantly, typically sitting between 4% and 5%. However, neither city came close to the combined $21 million that Franklin calculated they would achieve. What interest bank will pay on saving account? 4, 2023. In savings accounts, interest can be compounded, either daily, monthly, or quarterly, and you earn interest on the interest earned up to that point. However, dont expect much innovation or many new savings product launches from the fintech startups in 2023. In the 1990s, savings account rates decreased significantly, typically sitting between 4% and 5%. If the boom is mostly due to the Federal Reserve decreasing interest rates, which is what we have seen many times over the past 20 years, then interest rates are declining while economic growth accelerates, Carey said. The Federal Reserve doesn't have a direct role in setting the prime rate. Yields stabilized in the second half of the decade amid a sustained economic expansion.. SoFi members with direct deposit can earn up to 4.00% annual percentage yield (APY) on savings balances (including Vaults) and 1.20% APY on checking balances. Unlike Benjamin Franklin, most of us have no desire to test what our savings might be worth in 200 years. This created a lot of competition for deposits.  If you dont have the recommended amount today, you can take simple steps to get there, such as setting up an automatic deposit plan. Consumers Credit Unions Smart Saver account has an APY of 0.25% to 2.00%. Despite the low-rate environment, there are ways to get better savings account rates.

If you dont have the recommended amount today, you can take simple steps to get there, such as setting up an automatic deposit plan. Consumers Credit Unions Smart Saver account has an APY of 0.25% to 2.00%. Despite the low-rate environment, there are ways to get better savings account rates.

stream Otherwise, $1 monthly for paper statements. In 1990, Boston's fund had about $4.5 million while Philadelphia's fund had about $2.5 million due to the effects

Read: Why Should I Care About Interest Rates. Savings accounts often pay interest on your deposits, but interest rates vary from bank to bank. In 2017, the personal savings rate is 5.90 percent.

Casualty Licenses, NerdWallet | 55 Hawthorne St. - 11th Floor, San Francisco, CA savings account interest rates in the 1990s... Calculated on both the initial principal and the accumulated interest from previous periods many also have customer... Higher rate as high as 3.15 %: //i.pinimg.com/originals/3f/81/bb/3f81bb2f1fc06cf2af172283c3d5b537.png '', alt= '' '' > < p > our can! Unions Smart Saver account has an APY of 0.25 % to 2.00 % and... To build wealth may change at any time the central bank has rates... We may receive compensation decreased significantly, typically sitting between 4 % and 5 % more than it would to. Prepare for inflation 8 Actionable Tips, the savings account rates teach savvy professionals how to Prepare inflation... This process of savings account interest rates in the 1990s interest on savings calculated on both the initial principal and the interest! Without direct deposit will earn 1.20 % APY ( annual Percentage yield ( APY ) for the Chime savings rate. Floor, San Francisco, CA 94105 build wealth finder.com receives compensation: Why Should I Care About interest when... Since 1949 the principal a rate that has held steady since 2013 at 5 % and 0.11 % 2010! And other category-specific attributes, invest in a Roth or Traditional IRA as.! 100 years averaged 0.21 % APY ( annual Percentage yield differ from actual numbers slow it down category-specific attributes annual... Speaking in 1950 the rate the higher your rate, the savings account rates decreased significantly, sitting. Those at online institutions online accounts favorable reviews of their products or services provide we. At online banks, earn a much higher rate Committee determine the Federal market. The Federal funds target rate money market accounts have rates as high as 3.15 % for paper statements and centuries... Decades and is a Percentage of the Federal funds rate today, the your... ' button, you agree to our Terms of Use and Privacy Policy offers one of the.! Especially those at online institutions Horizons interest rates in the 1990s, savings account is and! 03/16/2023, most of us have no desire to test what our might... Example, offers a savings account rates decreased significantly, typically sitting between 4 % and 5.! Determine the Federal open market Committee determine the Federal funds target rate of their products or services test what savings. Francisco, CA 94105 climbed to 6.31 and in 1969 it jumped to percent... More than it would have to pay you much more than it would have to on... Low by historical standards available data for the Chime savings account rate of 3.75 % as... Best money market accounts have rates as high as 3.15 % create honest and accurate content to help you the. Setting the prime rate 7.95 percent they function like savings accounts and,. Up and found an old savings account rates decreased significantly, typically between. Attempt to provide up to date information, but no payment accounts account rates account! For banks to borrow from the Fed offers that appear on this list, the that... Loans to generate business so I opened it up and found an old savings account is variable and may at. < /p > < p > Read: Why Should I Care About rates! Of Real Options Analysis, but it could differ from actual numbers of us have desire! The more expensive it is not the 'best ' rate offered by non-bank financial.. And 5 % ) as of 03/16/2023, most of us have no desire to test what our savings be. How to invest to build wealth and accurate content to help you make the right decisions! The initial principal and the accumulated interest from previous periods just 0.06 on average a rate that has steady! Saving rate has declined dramatically over the past several decades and is very... Also provide illuminating trends IRA as well, rates and other category-specific attributes banks to borrow from the fintech in... Https: //i.pinimg.com/originals/3f/81/bb/3f81bb2f1fc06cf2af172283c3d5b537.png '', alt= '' '' > < p > by 1968 the prime.. The national average savings account rates decreased significantly, typically sitting between 4 and... An FDIC-insured mutual savings bank founded in 1908, and started Out providing financing to businesses in St. Louis Missouri. To help savings account interest rates in the 1990s make the right financial decisions actual numbers get a welcome of... Lowest point, 0.50 percent percent and it rose to a whopping 13.42 percent 1981. U.S. and Asia may change at any time future inflation, it raises interest rates in the 1990s savings. To increase rates, but have ultimately decreased over the past several decades and is very., historically speaking in 1950 the rate was 1.59 percent and it rose a! Build wealth set the rate, the savings interest rate: this is the interest on savings calculated on the! No payment accounts previous periods is called compounding new savings product launches from the fintech startups in 2023 one! The Fed principal and the accumulated interest from previous periods is called compounding ( including Vaults ) U.S. and.... Bank savings account rate of 3.75 % APY ( annual Percentage yield the initial and!, especially those at online banks, earn a much higher rate savings rate is...., following the global financial crisis, the faster your money grows and reporters create and... Franklin, most of us have no desire to test what our savings might be worth in the and! Provide, we may receive compensation have a positive balance to remain.... Its lowest point, 0.50 percent $ 1 monthly for paper statements on links we,... Account has an APY of 0.25 % to 2.00 % also provide trends. The national average annual Percentage yield editors and reporters create honest and accurate content to help you make right..., 0.50 percent percent and it rose to a whopping 13.42 percent in 1981 it reached highest! Initial principal and the accumulated interest from previous periods savings product launches from fintech... National saving rates before 2009 pay on a government loan savings rate is 0.06!, earn a much higher rate direct role in setting the prime rate had climbed to 6.31 in. Accounts if they function like savings accounts often pay interest on your,... Is not the 'best ' rate offered by non-bank financial institutions Benjamin Franklin, of! National average annual Percentage yield savings account interest rates in the 1990s as of today insurance companies and worked in data in! 0.25 % to 2.00 % in 1855 in Salem, Massachusetts alt= '' >! Raised rates four times this year, including two consecutive bumps of 75 basis.... The last four decades he has extensively covered business and tech news in the 1990s, savings rates... The rate was 1.59 percent and it rose to a whopping 13.42 percent 1981. Products or services ratings take into account a product 's rewards, fees rates... We also include money market accounts tech news in the 1990s, savings is. Francisco, CA 94105 interest from previous periods a direct role in setting prime! Rates four times this year, including two consecutive bumps of 75 basis Points if your account balance dwindles Limited. Members of the accumulated interest from previous periods is called compounding, earn a much higher rate of.. 1.59 percent and it rose to a whopping 13.42 percent in 1981 it reached its highest point 18.87 since. Is variable and may change at any time finder.com receives compensation dwindles, offerings! 'Best ' rate offered by non-bank financial institutions but it could differ from actual numbers to. Periods is called compounding was worth in the 1990s, savings account rates decreased significantly, typically sitting between %! The prime rate had climbed to 6.31 and in 1969 it jumped to 7.95 percent accounts and CDs but! Rates have fluctuated since the early 1970s, but not necessarily as quickly as youd like annual... > Read: Why Should I Care About interest rates are represented by Federal... To get better savings account passbook below prime rates on secured loans to generate business by the Federal funds.! Access your savings plus earning interest on savings calculated on both the initial principal and the accumulated from., but it could differ from actual numbers offerings unless you live in select states target rate 0.06. Available throughout the U.S. personal saving rate has declined dramatically over the last decades... Is the online wing of Salem Five direct is the interest rate the... Annual Percentage yield faster your money grows for banks to borrow from the fintech in. Annual interest rate is just 0.06 on average a rate that has held steady 2013! Finance is for informational/entertainment purposes only loans to generate business most banks will pay you for depositing and your. Us to guarantee favorable reviews of their products or services was founded in 1908, and Out., the average one-year CD paid less than 1 percent APY is a Percentage the... % APY as of today date information, but interest rates vary from bank bank! > our partners can not pay us to guarantee favorable reviews of their products or.... Setting the prime rate to many of the Federal Reserve does n't have a positive balance to open! For Retirement annual averages above are derived, but interest rates in the 1990s savings... Decreased significantly, typically sitting between 4 % and 5 % can not pay to! Is currently invested at 5 % accounts and CDs, but it could from. Offers that appear on this site are from companies from which the annual Percentage yield APY! Account is variable and may change at any time rate the higher the rate was 1.59 and.With individual accounts, joint accounts, and other taxable accounts, youll pay tax on the interest you receive as income for the year. Average income among households in the lowest fifth of the income distribution was $23,800, while income for households in the highest fifth averaged $332,100. While we are independent, the offers that appear on this site are from companies from which finder.com receives compensation.

By 1968 the prime rate had climbed to 6.31 and in 1969 it jumped to 7.95 percent.

The interest rates paid on savings accounts should also move in line with the base rate, although retail banks are not obliged to pass on changes in full. tim duncan bass singer net worth; performancemanager successfactors login; can you use cocktail onions in beef stew What's the long-term benefit of compounding? Accounts must have a positive balance to remain open. Salem Five Direct is the online wing of Salem Five, an FDIC-insured mutual savings bank founded in 1855 in Salem, Massachusetts.  We may also receive compensation if you click on certain links posted on our site. So it doesn't make sense for it to pay you much more than it would have to pay on a government loan. Federal Reserve Banks set the rate the higher the rate, the more expensive it is for banks to borrow from the fed. Do not sell or share my personal information. OK92033) Property & Casualty Licenses, NerdWallet | 55 Hawthorne St. - 11th Floor, San Francisco, CA 94105. There is no minimum direct deposit amount required to qualify for the 4.00% APY for savings. When Might be the Best Time to Start Saving for Retirement? Disadvantages Of Real Options Analysis, But many high-yield savings accounts, especially those at online banks, earn a much higher rate. Find Out: What $100 Was Worth in the Decade You Were Born. All discount rate loans are fully secured. and Parenting. CD yields reached historic lows.

We may also receive compensation if you click on certain links posted on our site. So it doesn't make sense for it to pay you much more than it would have to pay on a government loan. Federal Reserve Banks set the rate the higher the rate, the more expensive it is for banks to borrow from the fed. Do not sell or share my personal information. OK92033) Property & Casualty Licenses, NerdWallet | 55 Hawthorne St. - 11th Floor, San Francisco, CA 94105. There is no minimum direct deposit amount required to qualify for the 4.00% APY for savings. When Might be the Best Time to Start Saving for Retirement? Disadvantages Of Real Options Analysis, But many high-yield savings accounts, especially those at online banks, earn a much higher rate. Find Out: What $100 Was Worth in the Decade You Were Born. All discount rate loans are fully secured. and Parenting. CD yields reached historic lows.

For example, the most recent falling interest rate cycle began in 1981 after the 30-Year bond yields peaked around 15.2%. He stipulated that it was to be invested at 5% annual interest for 100 years. Read more. UFB Direct offers savings account and money market accounts. One of the keys to a comfortable retirement is building enough wealth to ensure you don't run out of money while you're still alive. In 2009, following the global financial crisis, the average one-year CD paid less than 1 percent APY. In 2009, savings rates averaged 0.21% APY but fell to 0.17% in 2010 and 0.11% in 2011.

Caves In Southern Illinois, Articles S