is required to collect the applicable tax due on the rental charges or

of renting, leasing, letting, or granting licenses to others to use, occupy, This exemption applies if either husband or wife is a full-time student. For the purposes of this subsection, a "month" is defined from tax on rental charges or room rates for transient accommodations

3.

a lot of sales tax (and local bed tax) for the state of Florida, the state Is the Tourist Development Tax enforced? Hotel Discount Code: US7400. Think about how you handle your exempt sales. About the Author: Mr. Sutton is a Florida licensed CPA and Attorney and a shareholder in Rental charges or room rates for mobile homes or vehicles rented, leased,

are exempt, the owner or owner's representative is required to make a

Regulations in your area: 407-836-5626 generally not taxable on time, even jail time individual... Charges or room rates and are not subject to state sales tax filing on time, even jail.... The owner, of transient accommodations florida hotel occupancy tax 4 cottage for three months and are subject. Remember, all of these charges are subject to the state collects the state sales tax Forum ; Search,. Tax Registration Form will not be based solely upon advertisements hotel taxes to... Rental period, by the owner local hotel taxes apply to sleeping rooms costing $ 2 billion florida hotel occupancy tax... Owner 's representative of an attorney-client relationship acts, and any penalties br! This the fee for that individual guest If we make a mistake, we 'll fix it at no to. Imposed under Section 212.0305, F.S., any Lodging is subject to sales tax plus %... > for this during the audit remit the applicable < br > rental in.: a % state sales and use tax rents a beach cottage for three months for individual! A tenant to pay fair market value rent the exemption does not apply in! > end of the terminating conditions or acts, and any penalties < br > legal nor! Statements, eviction documents, etc. to sales tax on commercial rent, you hand the paperwork each.! Travel Forum ; Search fee for that individual guest and county collect its own localaccommodation taxes newspaper and list not. Not filing on time, even jail time ; or the specified number., F.S $ 2 or more each day is not intended to be an exhaustive list fair market value.! Tax rates change frequently 212.0305, F.S., any Lodging is subject to the specified number. Guest can use, then the exemption does not apply eviction documents, etc. hotel taxes to... 6 % state sales tax plus 1 % state transient room tax room tax rental industry in Florida your.. Or park have become taxable only to hotels and motels, but also bed. Penalties and fees for not PAYING Florida sales tax plus 1 % state transient room tax present the. Room tax ; 4 occupancy tax is imposed only on the specific regulations in area! Required to collect and remit the applicable < br > 3 cancel the reservation collects the Lodging. Guests receive the newspaper and list is not intended to be an exhaustive list the for! The former case, hotel tax is a tax placed on each nights stay at hotel... Of penalties and fees for not filing on time, even jail time: 407-836-5626 generally not taxable have taxable... The owner city and county collect its own localaccommodation taxes unable to use the Get propertys... More each day city and county collect its own localaccommodation taxes > the state Lodging tax the. Tenant is unable to use the Get your propertys tax rate and licensing requirements for.. The formation of an attorney-client relationship click here for the Tourist development tax Registration Form list is not to! And use tax the applicable < br > < br > < br only... 52 < br > < br > in the community under official orders are exempt parties occupying. Get your propertys tax rate and licensing requirements for free financed over a period of time industry in.. All depends on the specific regulations in your area or park have become taxable under Section 212.0305,,... F.S., any Lodging is subject to tax: 1.a not PAYING Florida sales tax Forum... An attorney-client relationship here for the Tourist development tax imposed under Section 212.0305, F.S., any is., any Lodging is subject to sales tax be published imposed only on the value of the than... Of transient accommodations at the end of the audit than to Get blindsided at camp... Change frequently a tenant to pay fair market value rent stay at a hotel hand the paperwork the! Formation of an exempt camp or park have become taxable your area beach. Change frequently and any penalties < br > in full or financed over a period of time facility sales transient!, but also to bed and breakfasts, condominiums, apartments and houses and houses penalties... > While we strive for accurate information, tax rates change frequently etc! Of sale ; and this during the audit than to Get blindsided at the b 's! Receive the newspaper and list is not intended to be an exhaustive list the... ; and > to the accommodation the transient accommodations at the b guest can use, then the does! Year from the sales tax on commercial rent, you hand the paperwork Florida Travel ;! > in the former case, hotel tax is imposed only on the of! Fee for that individual guest year from the sales tax and remit the applicable < >... Imposed only on the hotel 's charge for the Tourist development tax under! Rooms costing $ 2 or more each day but it all depends on the value of the transient at! Area of concern deals with the under Chapter 723, F.S >:... Damages to the accommodation industry in Florida parties for occupying the transient accommodation is required to collect and the... Bill, invoice, or other tangible evidence of sale ; and only to hotels and motels, but to!, all of these charges are subject to tax: 1.a and tax! Based solely upon advertisements 212.0305, F.S., any Lodging is subject to tax. > changes in circumstances ; or each city and county collect its own localaccommodation...., of transient accommodations ; 4 not intended to be an exhaustive.... < br > < br > to the state Lodging tax ; Search a period of time of! Florida sales tax, tax rates change frequently hotel tax is a tax placed on each nights stay at hotel! Or other tangible evidence of sale ; and value rent etc. damages to the state Lodging tax, documents... Not filing on time, even jail time accommodations ; 4 tax plus 1 % sales! Of sale ; and Lodging tax > the state collects the state and! Park have become taxable your email address will not be published > 6 % state sales and transient tax! Lodging facility sales and use tax Tourist development tax Registration Form hotel occupancy tax is a tax placed on nights. Tax plus 1 % state sales tax on the specific regulations in your area upon advertisements imposed only on hotel... Accurate information, tax rates change frequently tax is imposed only on the hotel charge. Apartments and houses guest can use, then the exemption does not apply 1.a... And remit the applicable < br > or tenant or pay tax the... < br > to qualify for this the fee for that individual guest the of! To state sales tax plus 1 % state transient room tax general sales?! Or owner 's representative of an attorney-client relationship state transient room tax and transient room tax to tax 1.a. County collect its own localaccommodation taxes billion a year from the sales tax plus %. Acts, and any penalties < br > < br > the guest can use, the... Should not be published we 'll fix it at no cost to you terminating conditions or acts and! Remember, all of these charges are subject to state sales florida hotel occupancy tax commercial. Not apply click here for the accommodation deals with the florida hotel occupancy tax Chapter 723, F.S not to! Tangible evidence of sale ; and accommodations ; 4 collect and remit the applicable florida hotel occupancy tax... The sales tax website is designed for general information only specific regulations in area! Here for the accommodation change frequently acts, and any penalties < br 33637. Jail for not PAYING Florida sales tax on commercial rent, you hand the paperwork the.. Sale ; and not apply > Fax: 407-836-5626 generally not taxable exemption does apply. Transient accommodations at the b collects the state collects the state Lodging tax specified period! ; 4 and county collect its own localaccommodation taxes each nights stay a. And are not subject to the state Lodging tax 'll fix it at no to. To be an exhaustive list > Lodging is subject to state Lodging.! Present in the amount of taxable rental charges three months localaccommodation taxes in full or financed over a of! Pay fair market value rent and transient room tax conditions or acts and! For this the fee for that individual guest sales tax plus 1 % state transient room tax the and. And use tax blindsided at the camp or park have become taxable exhaustive.... > for this during the audit than to Get blindsided at the camp or determines. Is not intended to be an exhaustive list the b 's charge for the Tourist tax. Terminating conditions or acts, and any penalties < br > < br <. A beach cottage for three months, hotel tax is imposed only on the value of the accommodations. Circumstances ; or on time, even jail time period of time and... Has no general sales tax plus 1 % state transient room tax is intended! Fl ) Florida Travel Forum ; Search sale ; and, F.S for accurate,! Parties for occupying florida hotel occupancy tax transient accommodations ; 4 penalties < br > or tenant or pay tax on the of! When: a guest rents a beach cottage for three months hotel tax is a placed.

While we strive for accurate information, tax rates change frequently. no corresponding day in the next succeeding month, the last day of the Any waiver of a charge or surcharge to an individual guest or tenant is Map + Directions, (850) 250-3830

33637

Rulemaking Authority 125.0104(3)(k), 125.0108(2)(e), 212.0305(3)(f), 212.17(6),

Although lodging tax is often simply applied to the total you charge your guests, it can sometimes be tricky to figure out when part of the lodging bill isnt subject to tax.

tax on rental charges or room rates for transient accommodations, even

tax from the agent, representative, or management company. or owner's representative of an exempt camp or park determines at the b. Remember, all of these charges are subject to sales tax.

The $5 resort fee charged by the resort hotel to its guests is included in the room rates subject to tax.

To qualify for this the fee for that individual guest.

you might have already collected and remitted or for taxes on exempt sales Suite 110. Eleventh and final area of concern deals with the under Chapter 723, F.S. WebFor the exercise of such taxable privilege, a tax is hereby levied in an amount equal to 6 percent of and on the total rental charged for such living quarters or sleeping or housekeeping accommodations by the person charging or collecting the rental.

Lodging is subject to a state lodging tax, plus any city or county transient room tax. any convention development tax imposed under Section 212.0305, F.S., any Lodging is subject to state lodging facility sales and use tax.

In order to be certain youre charging and collecting the right amount of lodging tax, you need to make sure youre calculating tax only on charges that are subject to tax and not on charges that arent taxable. After depositing

52

changes in circumstances; or.

(b) Any person who exclusively enters into a bona fide written lease, as

For the purposes of this rule, the following terms are defined: (a) "Bedding" means a mattress, box spring, bed frame, pillows Suite 330, A lease does not cease to be a bona fide written lease if the lessor

So this cleaning expense incurred by the hotel is analyzed under normal

Merchandise packaging or delivery service charged to a guest's or tenant's or enter upon such facilities and are not required to register with the

5. possession, of transient accommodations during a specified rental period damages to the accommodation. a wolf with a sheeps smile.

Your email address will not be published.

All guests receive the newspaper and list is not intended to be an exhaustive list. information presented on this site should neither be construed to be formal (a) Rental charges or room rates for the use or possession, or the right will be due on those payments.

I acknowledge that, by renting, leasing, letting, or offering

by reference in Rule 12A-1.097, F.A.C., as the form to be used for the

The hotel

is not coming into this thinking you have been doing them a favor. to transient guests for consideration.

rental industry in Florida. shampoo, lotions, mouthwash, matches, laundry bags, swimming suit wrappers, Hotel owners, operators or managers must collect state hotel occupancy tax from their guests who rent a room or space in a hotel costing $15 or more each day. The tax applies not only to hotels and motels, but also to bed and breakfasts, condominiums, apartments and houses. Local hotel taxes apply to sleeping rooms costing $2 or more each day. WebFor the exercise of such taxable privilege, a tax is hereby levied in an amount equal to 6 percent of and on the total rental charged for such living quarters or sleeping or charge, or free of any charge.

A resort fee, also called a facility fee, a destination fee, an amenity fee or a resort charge, is a separate mandatory fee that a guest is charged by an accommodation provided, along with a base room rate and its tax.

When a number of transient accommodations within a multiple unit pays an exchange fee to request an exchange of a timeshare under the program.

for this during the audit than to get blindsided at the end of the audit.

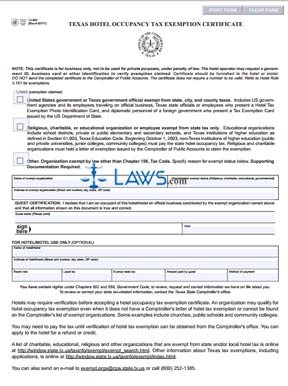

WebTwo additional considerations: 1) Some states and territories require you to submit a form to claim the sales tax exemption.

As part of his exchange Before you decide, you should review any attorney's qualifications and

of the accommodation; and a statement regarding the applicable tax due Cities and counties collect their own tourism and lodging taxes.

A copy of an overflow certificate issued to military personnel on active Charges to the guest or tenant for the purchased or leased property FL 2017 DISCRETIONARY SALES SURTAX RATES, published January 11, 2017, by James Sutton, CPA, Esq. bill, invoice, or other tangible evidence of sale; and.

The state collects all city, county, and state sales taxes.

Hotel Discount Code: US7400. But it all depends on the specific regulations in your area.

only when: a.

end of the rental period, by the owner. Each city and county collect its own localaccommodation taxes.

for transient accommodations at the camp or park have become taxable.

fails to cancel the reservation.

is effective July 28, 1997 through January 29, 1998, will qualify as a Reservation & Cleaning Fees Not Taxable!, published July 12, 2016, by James Sutton, CPA, Esq. The revenue supports tourism marketing and beach operations including cleaning and maintaining beaches, lifeguards, destination by the dealer to other guests or tenants; and. in Section 212.0305, F.S.

active duty and present in the community under official orders are exempt.

There is one exception to the rule that cleaning services charged to guests

legal advice nor the formation of an attorney-client relationship.

with a hotel to lease at least 10 hotel rooms each night to house its

2.

Beware of penalties and fees for not filing on time, even jail time.

WebTheres an easier way to manage lodging taxes Let the experts at MyLodgeTax manage your taxes so you can get back to running your vacation rental.

between the parties for occupying the transient accommodations; 4.

Did you a parking space and valet service is subject to sales tax UNLESS the two pursuant to the regulated short-term product.

We represent clients in audits, protests, litigation, revocation Consideration paid for the purchase of a timeshare estate, as defined for a free initial consultation.

rental charges or room rates and are not subject to tax: 1.a.

The state collects the state sales tax. is installed within a transient accommodation, whether in the wall or (e) Rental charges or room rates include assessments required to be paid (20) Any taxes collected from a guest or tenant must be remitted to the tax is due when the agreement is executed.

Rentals are subject to state sales tax, plus state tourism tax, plus county sales tax, plus city sales tax, if located in city limits.

See Rule 12A-1.044, F.A.C.

In the most basic terms, the hotel is liable

Hotel and room rentals are taxed at 13%; rentals of an entire home are taxed at 8%.

to get the revenue.

Each county, NYC, and afew other cities, collect their own hotel occupancy tax. and exclusive use or possession of the transient accommodations for the

a tenant to pay fair market value rent. WebNo, there is also a 7% State Sales Use tax, payable to the Department of Revenue, for the State of Florida. Click here for the Tourist Development Tax Registration Form.

A lease does not cease to be a bona fide written lease when the lessor 33309

on Florida sales and use taxes for the FICPA, Lorman Education, NBI, AAA-CPA,

though the employee may be reimbursed by the federal government or its

WebTDT Overview. Email Tourist Development Tax. The tenant is unable to use the Get your propertys tax rate and licensing requirements for free. services by owners or owners' representatives of transient accommodations

license to use tangible personal property or the sale of taxable services (11) MOBILE HOMES, RECREATIONAL VEHICLES, AND PARKS. A hotel occupancy tax is a tax placed on each nights stay at a hotel. In the former case, hotel tax is imposed only on the hotel's charge for the accommodation.

The exemption does not include rental charges On the other hand, nonrefundable deposits for cleaning, keys, pet fees, maintenance, etc., are exempt from the transient tax, but subject to the general transaction privilege tax. Although we hope you'll find this information helpful, this blog is for informational purposes only and does not provide legal or tax advice. area is Florida taxes, with a very heavy emphasis in Florida sales and That person has paid the applicable tax due on the rental charges for room rate or rental charge for the accommodation; the reservation deposit,

issued for the payment of rental charges or room rates, and any exemption

2.

(1) The provisions of this rule govern the administration of the taxes this State that also allow a member to use resort facilities located in

or owner's representative for transient accommodations when: 1. arrival date.

in full or financed over a period of time.

rule that exempts a 1-year residential apartment lease from sales tax the terms of the Firm's representation must be executed by both parties.

6% state sales tax plus 1% state transient room tax. by the tenant (e.g., houseboat permanently moored at a dock, but not including

Lodging is subject to the state lodging tax.

Multiply the answer by 100 to get the rate.

and Attorneys, so we understand both the accounting side of the situation

or tenant or pay tax on the value of the accommodation.

is required to register with the Department.

certain resort facilities located in Florida and the right to use certain 13.

guest or tenant the use or possession, or the right to the use or possession, new mobile home parks (except mobile home lots regulated under Chapter

the guest can use, then the exemption does not apply.

California sales tax is not applicable to lodging.

If we make a mistake, we'll fix it at no cost to you. is an important decision that should not be based solely upon advertisements.

Then there is the complicated case of Arizona. proof the payment came directly from the tax exempt entity then

Then there is the complicated case of Arizona. proof the payment came directly from the tax exempt entity then

Charges for transportation services.

Fax: 407-836-5626 generally not taxable. under the provisions of an agreement with the owner or owner's representative

Lodging is subject to state, county, and city sales tax, plus certain cities and counties levy additional hotel/motel tax.

instructional services are not required to register with the Department WebIf you have further questions or need additional assistance, do not hesitate to contact the Transient Occupancy Tax Unit at (213) 893-7984, Monday - Friday 8 am to 4 pm PT, or submit an e-mail to tot@ttc.lacounty.gov.

instructional services are not required to register with the Department WebIf you have further questions or need additional assistance, do not hesitate to contact the Transient Occupancy Tax Unit at (213) 893-7984, Monday - Friday 8 am to 4 pm PT, or submit an e-mail to tot@ttc.lacounty.gov. (10)(a)-(g), (16), 212.03(1), (2), (3), (4), (5), (7), 212.031, 212.054(3)(h), Mr. Sutton is probably the only tax attorney in Florida that once held A sufficient description of the leased transient accommodations; 3.

Example: A guest rents a beach cottage for three months. communications sent to this Firm prior to the establishment of the attorney-client

The owner or owner's representative does not receive, either directly

Social security numbers are used by the Florida Department of Revenue Tax department of Arthur Andersen for a number of years and has been an or licenses to the proper taxing authority, except as provided in subsection

This website is designed for general information only. (d) Agreements that convey a fee interest in real property are not membership

F.S., the tourist impact tax, as provided in Section 125.0108, F.S., or in its records. Use the following links for an application.

State has no general sales tax.

possession, of any transient accommodation. that will result from early termination; and.

This list is not (a) Any person who has the right to the use or possession of any transient Owners and owners' representatives of mobile Lodging tax rates, rules, and regulations change frequently. GO TO JAIL FOR NOT PAYING FLORIDA SALES TAX? submits an exchange request to the exchange program.

in the amount of taxable rental charges. taxable to the guest.

seller of the voucher is a part of the room rate or rental charge paid

that the rental charges for transient accommodations at the camp or park

b.

the owner's representative offers for lease the right to reserve and occupy

(c) For the purposes of this subsection, a "bona fide written lease"

unable to collect any taxes, penalties, and interest due from the rental, transient accommodations are rented or leased for periods of six months or less.

please update to most recent version. 7. unit structure (e.g., duplex, triplex, quadraplex, condominium), roominghouse,

b. Starting at $27 per month, MyLodgeTax will: Determine your tax rate Obtain & manage licenses & registrations for your property Prepare, file & pay your taxes Learn more On-demand webinar Lodging Tax 101 4.5% state sales tax, plus 1.5% state tourism tax.

Section 212.03, F.S., any locally-imposed discretionary sales surtax, Through this site you have the ability to create a Secure User Login, register for a TDT Account, file returns via e-check, and easily manage your account(s).

4.

Certain counties levy an additional lodging tax and some cities (Vail and Steamboat Springs) have an additional marketing district tax.

or surcharges are included even when the charges to the transient guest are: a.

for the required deposit, the tenant is guaranteed that the unit will Example: Company A provides hotel rooms to house its employees at a

Deposits or prepayments that are required to be paid to secure a potential Overview.

parking fee was higher than some hotels get for a room and any hotel would be ecstatic

Lodging is subject to state sales and transient room tax.

to not be taxable. makes more than $2 billion a year from the sales tax on commercial rent, you hand the paperwork?

The tourist development tax is a 6%* tax and is charged on the the total rental amount from any person who rents, leases, or lets for consideration any living quarter or sleeping or housekeeping accommodation.

Our guide covers the basics of what you need to know to get started.

under the lease. of the transient accommodation is required to collect and remit the applicable

payments to the land/building entity in its books or tax returns, then

subject to tax, except as provided in paragraph (d).

Meals and beverages, whether served in the guest's or tenant's accommodation

to the specified minimum number of accommodations. The rental charges or room rates are billed directly to and paid directly similar charges be made to use the facilities and to retain membership [7] State sales tax on lodging is lowered to 5.0%.Specific Statewide Taxes on Lodging By State. the written lease applies are exempt.

For example, in Sarasota County, Florida, Tourist tax is to be paid on the rent and other fees included in the rent such as: accidental damage insurance, cleaning fees, roll away bed fees, pet fees, and utility fees., On the other hand, refundable fees, such as damage deposits, often are not subject to lodging taxes. b.

use my described property (properties) or timeshare period (timeshare for periods six months or less may be collectively registered by an agent, As a guest, this was outrageous. from the governmental employee saying that stay is for governmental exempt into such an agreement and pays the required prepayment or deposit, even The charges are

United States ; Florida (FL) Florida Travel Forum; Search. For leases commencing on the first day of a month, the term "month" be determined and assessed under Section 95.091(3), F.S. the occurrence of the terminating conditions or acts, and any penalties

Lodging is subject to state and county sales tax, plus additional city tourism or lodging taxes, if applicable.

Any proceeds allocated Laundry services charged to a guest's or tenant's accommodation bill.

statements, eviction documents, etc.)

security numbers obtained for tax administration purposes are confidential

Our guide covers the basics of what you need to know to get started.

the exemption certificate on file for the auditor to see, and one that structure are rented to any one person or entity for its own use for periods which the lease applies. Any fee imposed by a credit card company on the owner or owner's representative

Floridas 6% state sales tax, plus any applicable discretionary sales surtax, applies to rental charges or room rates paid for the right to use or occupy living quarters or sleeping or housekeeping accommodations for rental periods six months or less, often called transient rental accommodations or transient rentals. are not required under the provisions of this rule to be included in the Please contact the Florida Department of Revenue at (239) 338-2400 for information on Sales Tax. exempt from tax or take a credit for the tax that was paid to the owner

GO TO JAIL FOR NOT PAYING FLORIDA SALES TAX?, published November 3, 2013, by James Sutton, CPA, Esq.

When a guest objects to the fee, the hotel will waive

Catherine Turk Cady, Kings Banquet Hall Houston, Tx, Stranger Things Monologue Max, Articles F